Consolidation of Accounts in Odoo 15

Functional

A proper and methodical keeping can be a blessing for the company especially as it grows beyond a parent organization to develop into a resonating name across industries and borders.

Financial errors could land the company in even legal complications. Finances and accounts keeping cannot be light-handed. As parent companies grow, there are quite many acquisitions, mergers, and investments made. Maintaining the accounts of all these is quite important. As important as this, is the reviewing of the accounts of the acquired companies and the invested companies.

Companies maintain a consolidated record of the various subsidiary companies and their financial record. The financial records are combined with the parent company. This review would require modifying the records to match the revenues and expenses between the accounts.

Consolidation of accounts would involve various processes like

- Documenting intercompany loans

- Charge payables, payrolls, corporate overhead, etc.

- Verify and adjust the assets and liabilities

- Correct and adjust the entries of revenue and expenses

- Make currency adjustments depending on the parent company and subsidiary company.

Consolidation of accounts is an extensive and thorough process and one that demands a huge amount of time and effort from the accounting department.

Consolidation is a key process for multi-company organizations and multinational companies. For the financial statement of an organization to be complete, consolation is inevitable.

The consolidated accounts allow the parent company to assess its grip over subsidiaries. The total assets and liabilities are reviewed with consolidation. This review allows a better comprehension of the resulting control of the parent over the others.

Automation of this meticulous process would be time-saving and hence quite advantageous for the parent company. Though complete automation is not possible or even suggested by experts, a lot of the steps can be automated to avoid confusion and mixing up of data. A more systematized working would mean less space for error and improved accuracy. The financial processes of a company, from the least to the most meticulous, have absolutely no space for errors.

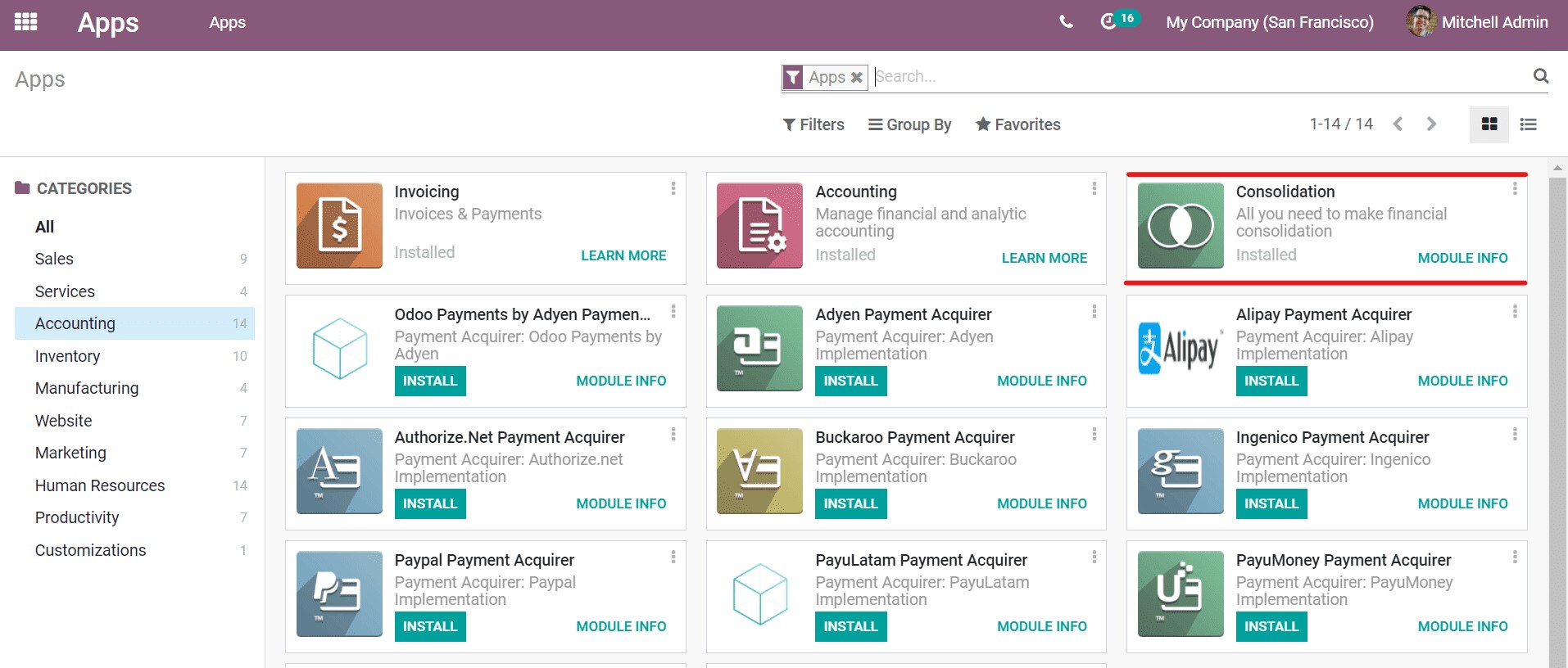

Odoo Consolidation is a dedicated app developed to make all the financial consolidation of a company. From the Odoo apps, we can filter the accounting apps to find Consolidation. The module is only needed for companies with subsidiaries or sister companies.

Configuration

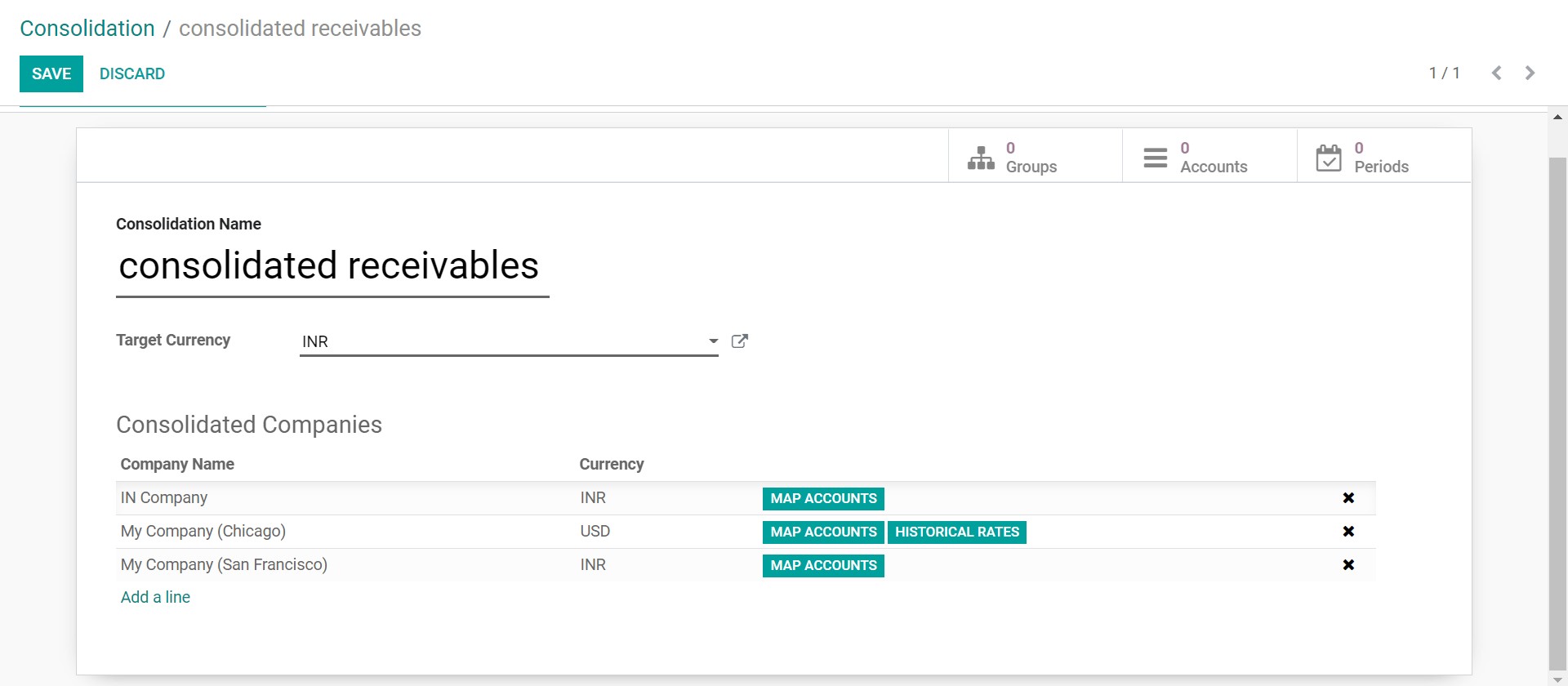

In the configuration, we can create a consolidation. We can create a consolidation for all companies configured in the database or choose the companies needed.

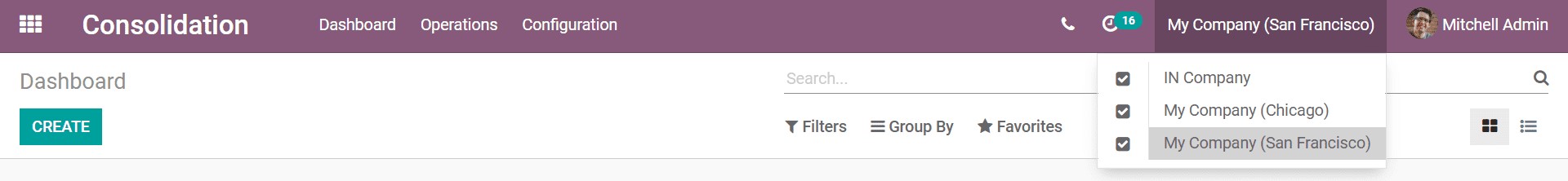

The target currency and the companies are selected. From the groups, we can create account groups and from the accounts, we can create and add consolidation accounts. We should enable access to the data from all three chosen companies by checking them in the companies menu on the top bar.

One can create analysis periods and account groups in the configuration. Creating an analysis period would require us to define the start and end dates of the accounting analysis. Account groups can choose from the consolidation created and then given a parent company. The consolidation accounts can be chosen from those already created. We can also create subgroups from the parent account groups.

Consolidation

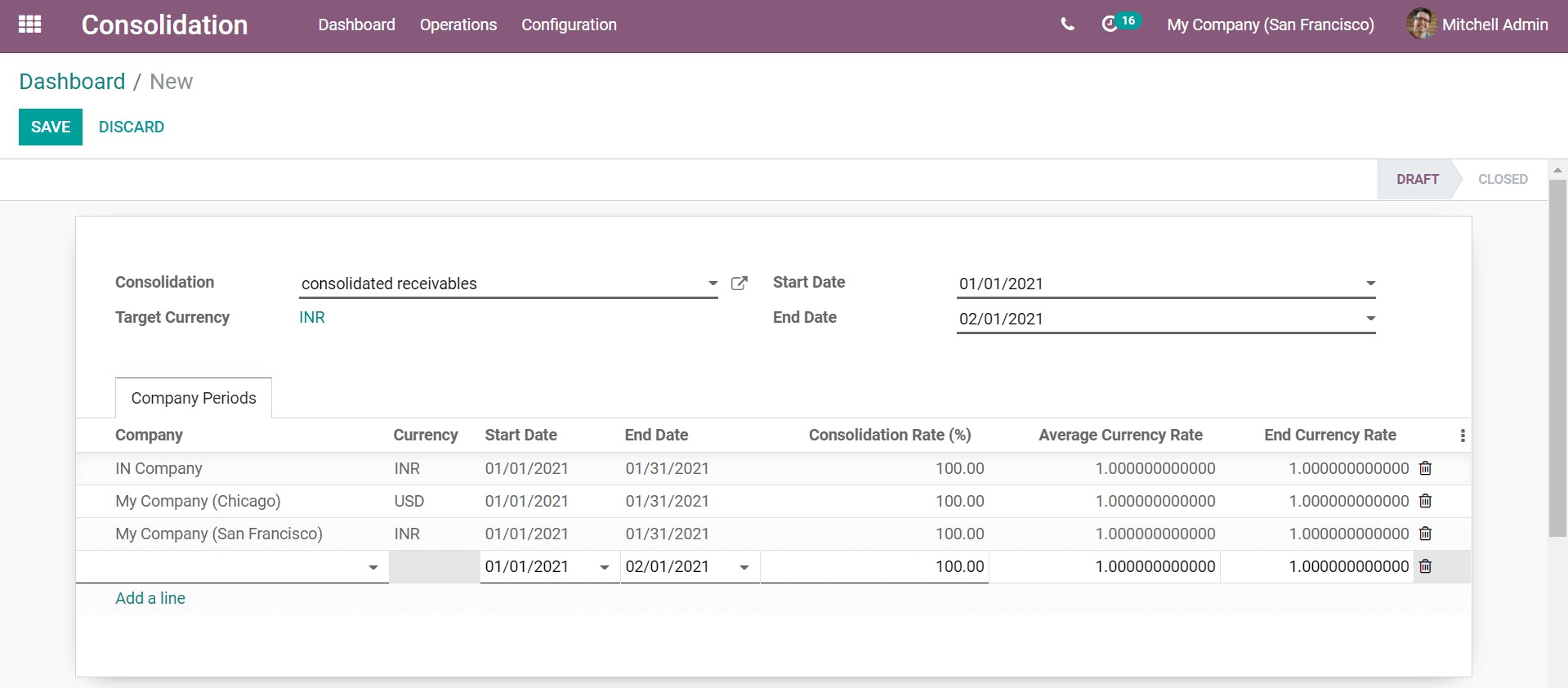

One can create a new consolidation analysis from the dashboard. One can choose an already created consolidation or create a new one. For the existing consolidation, the companies list will be automatically updated. One can add more companies if needed.

One can name the consolidation allowing us to define currency and the companies. After defining the start and end dates one can modify the consolidation rate, average currency rate, and end currency rate. One can add companies and the currency defined in the company configuration will be updated in the currency column. The currency for the company can only be edited in the company configuration. To edit the currency one will have to make the changes in the company details.

Once consolidation is created one can access the details of accounts and the journal entry from the window of the specific consolidation. One can also compute the consolidated balance

Consolidated accounts

One can set up accounts from the initial start-up of the module, while setting up the charts of accounts or in the configuration. Alternatively, one can create them from the accounts tab of individual consolidation. By creating a new consolidation account, one can define the currency conversion method and add an accounts group for the consolidation accounts.

One can then add a new account by adding companies with their defined account types. One can also create new accounts and define the details of the account. One can choose the account type based on asset, liability, equity, and profit or loss. Default taxes, tags, and allowed journals are defined in the window. One can add more accounts under the accounts to create a consolidation account.

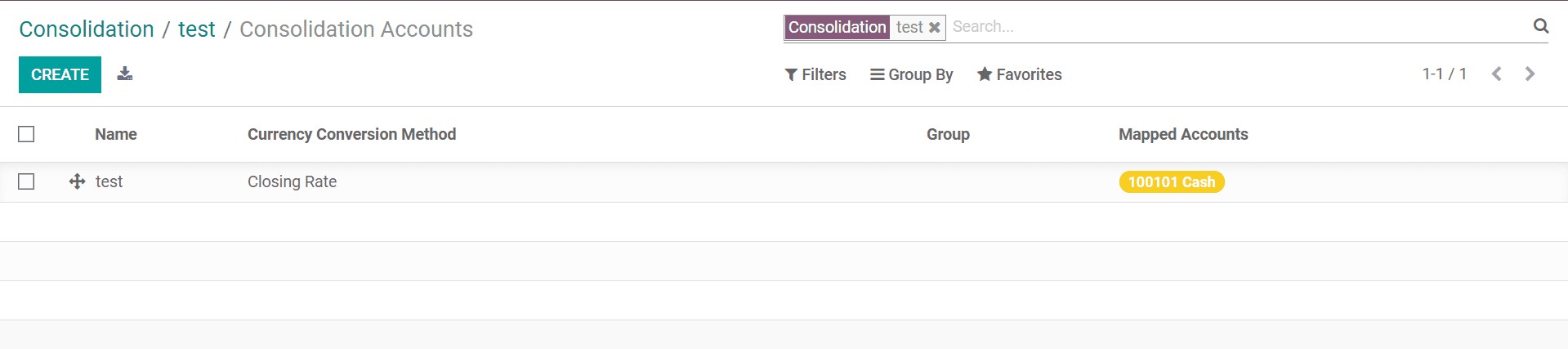

The consolidated accounts along with their currency conversion method, account groups, and mapped accounts will be displayed under the consolidation accounts. One can select consolidation accounts from these for configuring accounts of individual consolidation analysis.

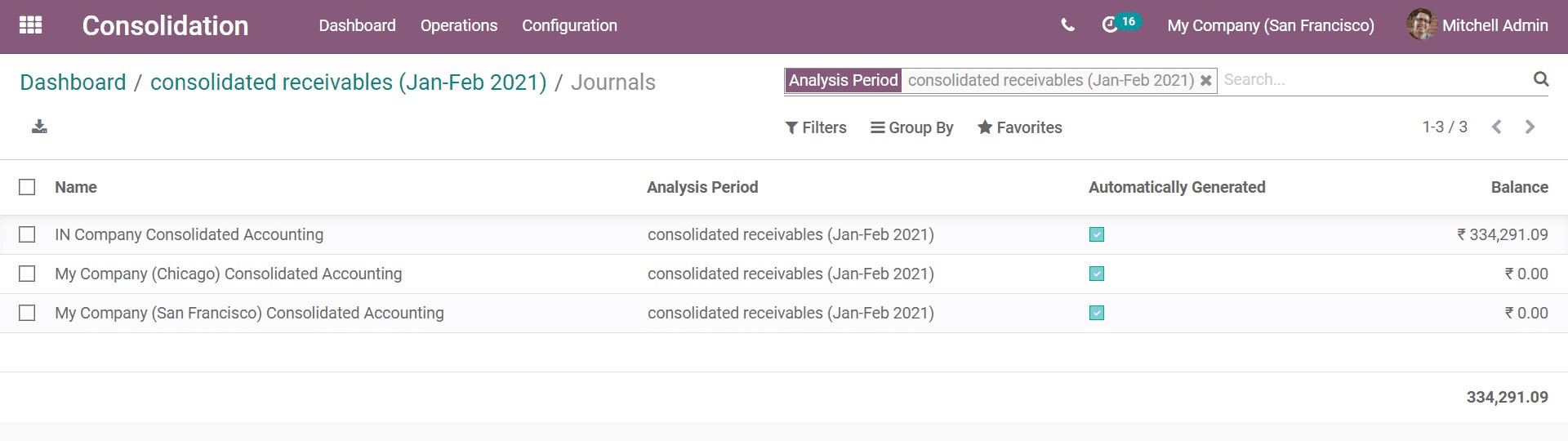

Journals

The consolidated accounts' journals can be accessed from the operations as consolidation entries. The journals tab in individual consolidation analysis will also show the journal entries. Once the consolidation analysis is computed, it will be saved in the journal entries.

Close or recompute consolidation

Consolidation can be closed or recomputed from the window of the specific consolidation. One can recompute the consolidation after every change is made and this will modify the journal entry as well. Once the consolidation is closed the status would change from draft to closed. It would also tag the particular consolidation as closed in the dashboard.

Consolidated Balance and Trial Balance

From the edit option of the consolidation analysis, One can view the trial balance. If necessary we can add another column and choose a consolidation account. After making the changes needed we can avail the consolidated balance sheet. We can view the print preview, edit or export the consolidated balance sheet as an .xlsx file.

The consolidation module is very effective and useful for multi-company configuration. The accounting work is simplified substantially by configuring and integrating the database with the module.